Key Takeaways

- A digital asset management software solution helps financial institutions avoid scattered, outdated files and ensures that teams always find the correct version of each asset.

- The global DAM market is poised to grow from $5.3 billion in 2024 to $10.3 billion by 2029—reflecting finance’s recognition of DAM technology as a strategic game-changer.

- AI spending in financial services is set to double over the next four years, driving innovation in areas ranging from fraud detection to new product simulations.

The financial services industry is overwhelmed with paper and digital documents, and every piece of information must be carefully tracked to stay compliant. As manual recordkeeping becomes unsustainable, many financial institutions turn to a digital asset management system (DAM) to organise, retrieve, and securely store content.

According to a recent study from Juniper Research, 53% of the world’s population will access digital banking services by 2026. This illustrates just how quickly consumer expectations are evolving.

A robust digital asset management solution not only addresses security vulnerabilities but also meets growing expectations for personalised, on-demand access. Whether delivering tailored product offers, updating wealth managers with approved collateral, or sharing the latest performance data, a robust DAM system lets you upload digital assets and ensures your teams can always find them at the right time. This helps them build credibility and trust at every touchpoint.

In this article, we’ll explore the role of DAM software tools in financial services and outline the practical features to look for when selecting the right solution.

Why Financial Services Need Digital Asset Management (DAM)

Financial services organisations face mounting pressure to deliver seamless, consistent, and compliant digital experiences. With teams scattered across the world and growing volumes of content, siloed file systems can cause chaos. A digital asset management solution provides a single repository for all brand assets.

The demand for digital files in the industry cannot be overstated. Whether it’s marketing campaigns, product sheets, or regulatory documents, every asset must be accurate, accessible, and on-brand. Yet many organisations struggle with the same problems:

- Brand consistency and accessibility: Without centralised brand guidelines, outdated branding can slip through in branded content, causing trust issues.

- Version control: Multiple contributors can create redundancy and confusion, especially around media assets like videos and creative files.

- Compliance nightmares: Financial regulators closely monitor how data is securely stored, shared, accessed, and retained, making manual tracking risky.

For many banks, marketing assets and disclosures are scattered across multiple departments. These siloed systems result in disconnected communications and erode trust. Insurance firms, meanwhile, must coordinate resources for agents spread across different regions. Without a centralised storage location, outdated, improperly branded marketing materials slip through, damaging consumer confidence and sparking compliance issues.

Wealth and asset management teams need fast access to performance data, market reports, and research. Fragmented existing workflows leave advisors to potentially circulate stale information, opening the door to negative client experiences.

Collectively, these challenges undermine the entire business. A DAM system tackles them head-on by creating a centralised library that seamlessly integrates with project management tools and other sales enablement platforms, ensuring consistent content workflows and higher user adoption.

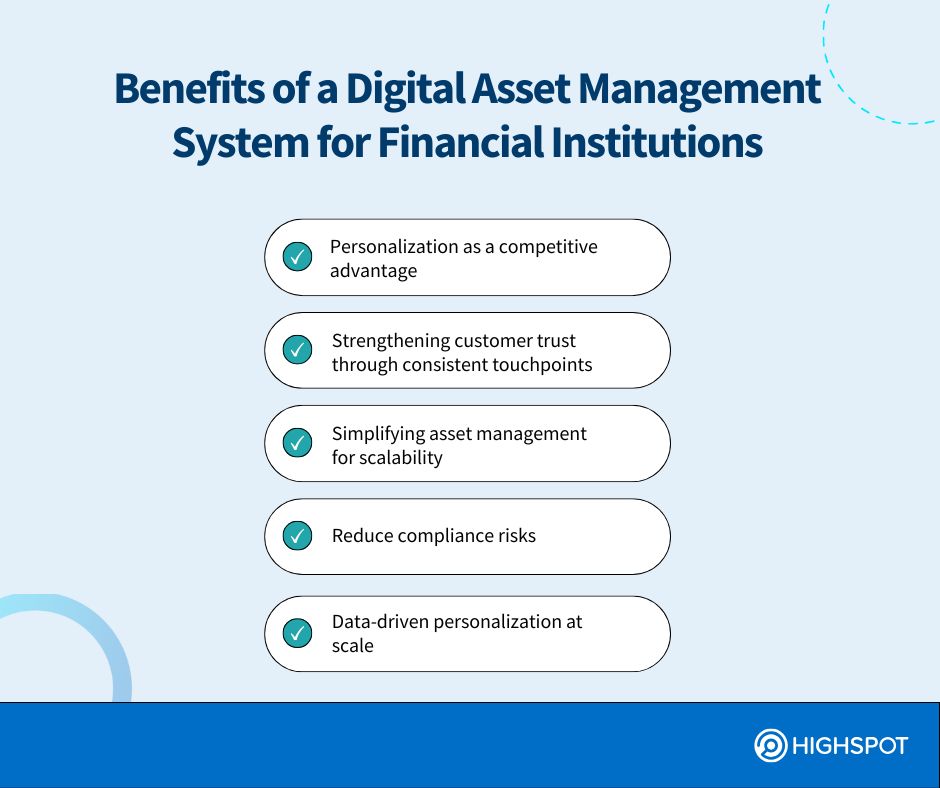

Key Benefits of a Digital Asset Management System for Financial Institutions

Implementing a digital asset management solution creates a ripple effect of operational efficiency, compliance, and marketing benefits. These payoffs are particularly significant in financial services, where information accuracy and timeliness can make or break a firm.

Let’s take a closer look at the advantages of a DAM system for financial institutions:

1. Personalisation as a Competitive Advantage

Financial institutions often compete on who offers the best and most personalised services. DAM empowers wealth managers to locate and deploy tailored product sheets from creative teams to targeted investment recommendations quickly and consistently.

A McKinsey study found that personalisation can cut customer acquisition costs by up to 50%, boost sales revenue by up to 15%, and deliver up to a 30% increase in ROI on marketing spend. Equally telling, 71% of consumers expect companies to personalise interactions, and 76% get frustrated when this doesn’t happen.

2. Strengthening Customer Trust Through Consistent Touchpoints

Consumer trust underpins any financial service. A full DAM platform ensures uniform messaging by centralising branded content, including logos, marketing copy, video assets, and disclosures across emails, social media, web pages, and apps.

Consumers do not want to see sloppiness and inconsistencies from firms managing their livelihoods. For instance, a wealth management firm might use DAM to serve the same on-brand performance reports across client-branded portals, email newsletters, and social media feeds. This unified client engagement reinforces credibility, as supported by Deloitte research, which shows that 88% of consumers who highly trust a brand will buy from it again.

Related Resource: What Good Client Engagement Looks Like

3. Simplifying Asset Management for Scalability

As financial organisations grow, so does their volume of digital content. A DAM system’s centralised repository, metadata management, and automated workflow management facilitate rapid updates, enabling sales teams to handle more tasks or clients during growth times without drowning in manual tasks. For example, an insurance company rolling out new policy documents can leverage DAM to rebrand, revise, and upload digital assets and approved materials to agents across different regions without repeated, manual follow-ups.

4. Reduce Compliance Risks

Compliance remains a persistent challenge in financial services. DAM mitigates risk through features like user permissions, version tracking, and audit logs, offering an end-to-end record of how documents are created, securely stored, and used. For instance, an SEC review might demand a complete history of how documents changed over time. DAM captures every iteration with a date and time stamp, protecting against fines and reputational damage.

5. Data-Driven Personalisation at Scale

As more digital asset management platform solutions integrate artificial intelligence (AI) tools, financial firms can quickly analyse client behaviours and preferences with fewer resources. Industry projections indicate that AI spending will climb from $35 billion in 2023 to $97 billion by 2027, representing a CAGR of 29%.

This trend continues to evolve, with future DAM capabilities expected by AI-powered client engagement, some of which are already here. David Parker, Accenture’s global financial services industry practices chair, predicts that as technology matures and regulatory frameworks solidify, financial services will leverage generative AI and synthetic data to reshape both risk management and customer engagement. Advanced predictive models will enhance fraud detection and compliance, while banks and wealth managers will simulate new products or economic scenarios without risking real capital.

One European neobank, bunq, already uses generative AI to accelerate its automated transaction monitoring for fraud and money laundering. This offers a glimpse into an AI-driven, proactive, and highly adaptive future.

Selecting the Right DAM for Financial Services

Finding a DAM that fits your revenue tech stack without overwhelming your team can be tricky. Below is a quick-reference chart outlining key features, their benefits, and a typical financial services use case.

Here are some key features to consider:

| Feature | Benefit | Use Case in Financial Services |

|---|---|---|

| Centralised asset repository | Single source of truth for your digital assets | Prevent compliance mistakes by ensuring you only use the latest, approved forms and disclosures |

| Metadata & tagging | Simplified search and organisation of digital assets, including media assets and creative files | Quickly locate brochures, disclaimers, audio files, or images for different client segments |

| Version control | Maintains historical records; eliminates confusion | Ensure advisors and creative teams only distribute the most current investment guidelines, disclaimers, or rate sheets |

| Role-based access | User permissions to maintain security and compliance | Confine sensitive data to specific departments while enabling multiple users, marketing teams, and sales teams to collaborate confidently |

| Automated workflows | Speeds up review and approval processes | Accelerate compliance checks for content production, ensuring timely distribution across web pages and all digital channels |

| AI tools | Turn data into structured, actionable insights, reducing manual overhead | Deploy specialised generative AI “agents” to automate processes with minimal human intervention, freeing staff for higher-value work |

| Digital sales rooms | Provide a secure, personalised online environment for buyer engagement | Give prospects or clients the ability to access digital assets, rich media, curated financial offerings, track interactions, and collaborate in real-time |

| End-to-end analytics | Deliver a comprehensive view of performance, from marketing efforts to sales outcomes | Measure asset engagement, track ROI, and refine strategy based on real-world usage data |

| Conversation intelligence | Offer real-time analysis of client interactions and sentiment | Transcribe and analyse voice or digital conversations for compliance risks, sentiment trends, and opportunities to improve messaging |

Transform Your Financial Services with Digital Asset Management

The stakes have never been higher for delivering accurate, compliant, and personalised experiences in banking, insurance, and wealth management. Digital asset management is the solution for organising all your digital assets in one place, ensuring secure storage, compliance, and supercharging marketing efforts. Institutions can meet rising consumer expectations and remain agile in an increasingly competitive market by investing in the best DAM software tailored to financial services.

Discover how Highspot’s sales enablement solutions can transform your digital asset management strategy and empower your teams to deliver meaningful, personalised experiences—exactly when and where your clients need them.

Request a Highspot demo today!